Blog

In this series, we are discussing the role of investors, technology developers (startups as well as established companies), accelerator programmes, end-users (e.g., water and wastewater utilities) and industry-experts in the battle against climate change with targeted reduction and mitigation technologies in the water industry. In the previous posts, I have explained why the early-stage diagnostics of climate or water technologies needs to be improved, why Tech Talk is essential early on in the discussions between investors and technology developers, how accelerator programmes unintendedly muddy the waters with their pitch-oriented selection procedure for promising startup teams, and how affordable market research and focus on sustainability can increase the chances of a successful market launch of sensor technologies for the water industry. In this fifth post, we revisit the original question regarding the funding of successful sustainable (water) technologies, and extract the key takeaways from the previous posts to improve the chances of success.

In the past month, I have tried to offer potential tools and approaches to improve early-stage diagnostics for promising climate technology (or water technology) startups, specifically sensor developers for the water industry. I realise that this overview is neither complete nor a ready-made blueprint for success, but I hope that it will open up a wider discussion on how we can do a better job at selecting water technologies for investment.

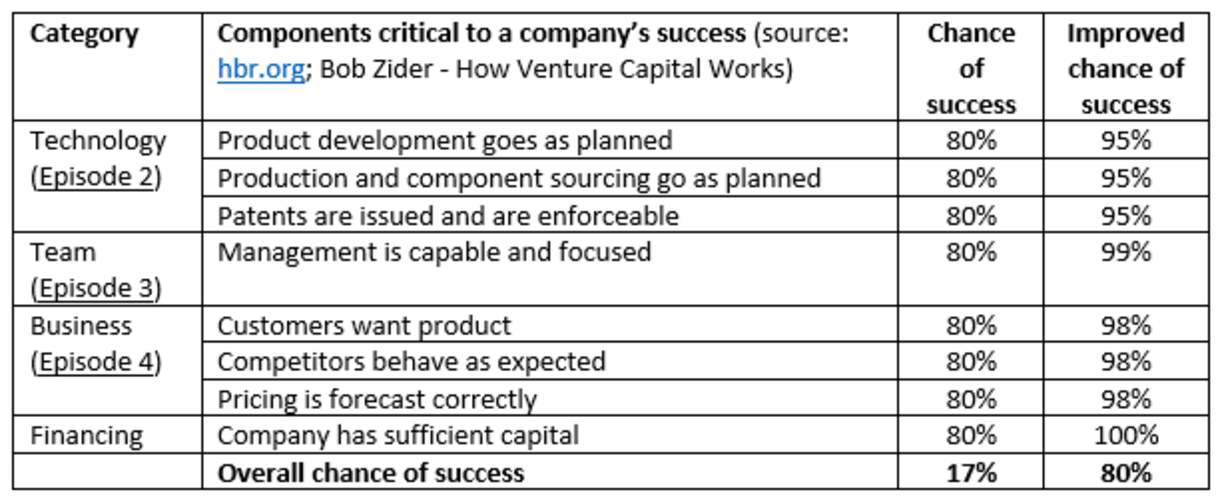

As indicated in the first episode of this blog series, Bob Zider identified eight components which are critical to the success of a startup. If any one of these components has an 80% chance of success, the overall chance of success for the entire company is still only 17%. However, if better early diagnostics can help improve the chances of success for each individual component as listed in the table below, the overall chance of success increases to a whopping 80%. I have deliberately put the financing category at 100%, assuming that the improvements in diagnostics for the technology, team and business are sufficient to give an investor the confidence they need to invest.

The unicorn has lost its horn

Both CIF (Episode 2) and ESG (Episode 4) can be helpful tools in determining whether a product or a company contributes positively to sustainability, especially for startup companies. This category is not included in Zider’s list but essential for the technology types we have been discussing. The eternal quest to find the next unicorn (i.e., a startup company valued at 1 $ billion) seems counterproductive when it comes to sustainable technology startups, as rapid growth at any cost is generally not the best way to allocate resources responsibly. Fortunately, a zoo of plausible alternatives has been proposed, from camels to honey bees. These business types have basic ESG-principles already baked into their core, sometimes borne out of necessity.

Water and wastewater utilities have a role to play

Despite everybody’s best efforts, the route to the water industry market for sensor technologies is a bumpy one. Municipal water and wastewater utilities can – in theory – be an excellent beachhead market segment. For almost any water technology, a sufficiently uniform group of utilities can be identified that represents a revenue-stream to keep a startup going for a while. As stated in Episode 2, water is a heavily regulated substance worldwide, and thus utilities should be interested in novel monitoring and sensing methodologies that will help them assess water quality risks and reap other benefits of sensor technologies. These include process optimisation, cost reductions and improved sustainability resulting from a reduction in the use of chemicals and energy during treatment. Unfortunately, reality is often different.

The reluctance of municipal utilities to adopt technological innovations causes many established companies to prioritise other market segments such as the food and beverage industry for new sensor introductions. For startups, it often poses a huge barrier to entry into the water industry market. An important hurdle is the generally lengthy decision-making procedures at (waste)water utilities which force technology developers to finance an unnecessarily long runway. Additionally, the need to conduct a seemingly endless series of pilot studies at many different water utilities, which often do not even end in successful sales, further complicates the route to market. This phenomenon has become so common that it has officially been dubbed ‘death by a thousand pilots’, and there are ‘jokes’ going around such as: What does the water industry have in common with the aviation industry? They both have very large numbers of pilots.

Anecdotal evidence suggests that accelerator programmes may actively discourage sensor (or related technology) startups from selecting the municipal water industry as their beachhead market, thereby reducing the overall innovative potential of the municipal market segment. This development is very concerning as it may slow down the digital transition of the (waste-)water utility sector in the process, which I think is an essential component to ensure safe and sufficient water provision in a future dominated by climate change and its associated major water challenges.

Turning the tides

In order for water utilities to (re-)establish themselves as reliable partners for innovative developments, innovation managers can play a crucial role in two key aspects. Firstly, internal decision-making processes should be streamlined to minimise delays. Extended discussions on whether to participate in a pilot study can have severe consequences for first-time technology developers, even leading to bankruptcy, and established companies may shift their focus to other market segments. Nonetheless, even while adhering to the strict regulations governing drinking water production and wastewater processing, creative solutions can be found to conduct pilot studies and assist technology developers in acquiring the data they need to arrive at a much-needed and valued product.

Secondly, the utility should recognise that pilot projects usually offer very limited benefits for themselves but are primarily useful for technology developers. Typically, (sensor) technology developers possess a wealth of knowledge regarding technology development but have limited expertise in drinking water production or wastewater processing. Therefore, it is very difficult for them to anticipate how the technology will function under the utility’s operational conditions. A lack of short-term benefits should, however, not deter water utilities, as this phase in the technology development process is essential to developing a product that functions effectively within the utility's operational framework, ultimately leading to significant benefits for the utility as well. Innovation managers can be important ambassadors for sensor developers by emphasising the long-term benefits of investing time and resources into pilot projects in order to ensure the availability of innovative technologies further down the road.

Alternative routes

Direct sales to individual (waste)water utilities are not the only available route to market. There is a growing trend towards the integration of sensors into other types of water technologies in order to optimise their performance and reduce costs, e.g., by minimising energy consumption. This opens up a whole new – and potentially much faster – route for sensor developers to sell their products in relatively high volumes as an OEM supplier to a (small) number of value-added resellers, i.e., manufacturers of pipes, pumps or (mobile) treatment systems. Especially startups may benefit from this trend, as they often do not yet have extensive sales channels in place for direct selling to (municipal) water utilities.

In summary

Improving early-stage diagnostics for promising water technologies and/or startup teams, specifically sensor developers for the water industry, can increase their chances of success considerably. Additionally, exploring creative new ways to enter the municipal water industry market segment is essential to increase the chances of success for sensor developers in the water industry. Water and wastewater utilities can contribute to technology improvements and uptake by proactively engaging in pilot studies with the primary objective of providing a learning experience for the technology developer.