Blog

In this series, we are discussing the role of investors, technology developers (startups as well as established companies), accelerator programmes, end-users (e.g., water and wastewater utilities) and industry-experts in the battle against climate change with targeted reduction and mitigation technologies in the water industry. In the previous posts, I have explained why the early-stage diagnostics of climate or water technologies needs to be improved, why Tech Talk is essential early on in the discussions between investors and technology developers, and how accelerator programmes unintentionally muddy the waters with their pitch events for promising startup teams. In this fourth episode, we will discuss how to obtain a better view of viable beachhead markets for water technology introductions, and the advantages of implementing ESG-principles at an early stage to emphasise their added value for water and wastewater utilities.

Numbers, numbers, numbers

When talking to a startup team about the development of their tap water testing device for the private consumer market, they presented the results of their market research. Since they were based in the USA, they had decided to explore their home market first, which is a very good choice. Here is what they found: Around 100 million Americans are worried about their tap water quality. If we can obtain 1-2% of them as a customer for a US$100 tap water testing device, our beachhead market is US$ 100-200 million. We expect to obtain that 1% market share in the fourth year.

Sounds great, doesn’t it? But let’s unpack this a little, and for the moment forget that the tap water testing device was unable to do what it was supposed to do, as I mentioned in the second episode of this series.

An important question that came to my mind was… how are you going to reach out to those 100 million people? Their answer was simple: social media. Of course, social media are a great way to reach out to large audiences, but how specifically do you connect with the 100 million Americans who are worried about their tap water quality? And next: how do you get 1-2% of them to actually purchase your product? To start with the latter question: the notion that a working piece of technology will sell itself is a fallacy. However, this does not stop numerous technology developers from thinking that if only they can get their message out there, the customers will line up by themselves to buy their product.

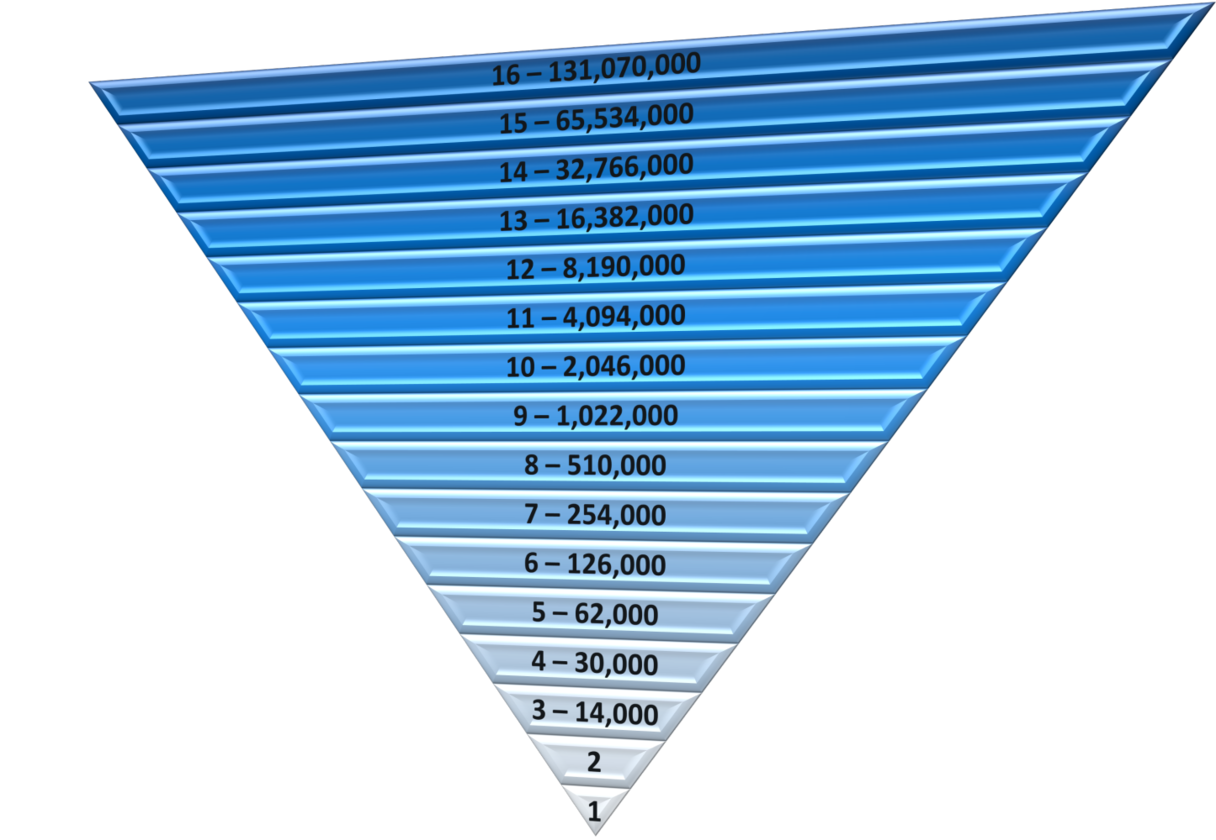

Back to the first question… how long does it take to build an audience of 100 million followers in order to filter out the small percentage of people willing to pay for a product? Let’s do the maths. Imagine that this startup has 2,000 followers on social media in the first year (which is rather a large number for a startup company with no product on the market yet, but hey, let’s give them a head start). Next, we are going to assume that they can grow their audience exponentially each year (investors love exponential growth), so in the second year, they grow their audience by 4,000 people, to reach 6,000 in total. The following year, exponential growth continues, so the audience grows by 8,000 to 14,000 in total. I am not sure how active you are on social media, but unless you are a famous pop star or a football player, keeping up exponential growth in the number of followers is not easy to accomplish. But let’s assume the startup remains on course to accomplish this, and exponential growth continues in the following years (16,000 new followers in the 4th year; then 32,000; 64,000; 128,000; etc.). In this way, it will still take 16 years to reach an audience of more than 100 million people (131,070,000 in the 16th year to be exact). Assuming that each year, 1% of the newly gained followers will purchase a US$100 product, it will take seven years to generate an annual revenue of more than US$ 100k.

It takes 16 years to grow an audience of more than 100 million people at an exponential growth rate

Now, imagine this startup going to an investor and requesting money to finance a 16-year runway while they gain the popularity of Rihanna or Real Madrid Football Club, in order to reach out to their 100 million people beachhead market and gain 1-2% of them as a customer. What do you think the investor’s response would be? Put like this, it sounds like a silly question nobody would ever dare to ask. However, in reality it does happen, albeit in other words…

Drill down, drill even further down, and then some…

I think this example clearly illustrates that this is not the best way to go. Given the available (limited) resources of the average startup, it is essential to select a beachhead market that is large enough to generate enough revenue for the first few years but small enough to be addressed effectively by a small team. Therefore, they need to drill down into these 100 million people and work out in more detail what characterises the 1-2% of this group that decides to purchase the tap water testing device. But how? First of all, maybe they should move away from numbers of people, and focus on households. If a tap water testing device is purchased, it will most likely be only one per household, even if two adults in the same household are both concerned about the quality of their tap water. As a second step, they could check the interactive map to track water safety, as developed by the Drinking Water Alliance in partnership with the University of California Agriculture and Natural Resources Department, and work out how many of those households are located in areas where drinking water issues have occurred and been reported in the news or on the internet. People who have already heard about drinking water quality issues in their area are more likely to be concerned about it, especially if they are the parents of children under 12 years of age. So, instead of targeting a very diverse group of 100 million people, we are now looking at households with one or more children under the age of 12, whose parents are more likely to be concerned about tap water quality because they live in areas where water quality issues have been reported in the past few years.

Next, the startup could narrow down its target market even further by examining the group of concerned households more closely. When concerned about tap water quality, people mostly tend to look for a solution rather than the cause of the problem. According to the 2023 consumer opinion study performed by the Water Quality Association (WQA), 71% of Americans use bottled water, and 45% have an additional water treatment system installed in the home. Both groups are considerably less interested in tap water testing devices as they have already added an extra layer of protection for their families. The same study shows that people using additional treatment solutions are more often college-educated home-owners with an income above US$ 100k. The potential buyers of testing devices are more likely to be renters with an annual household income below US$ 100k and not college-educated. Without going into the details of the demographics, this brief overview shows a (part of the) way to reduce the group of 100 million people to several thousand households that are more likely to be interested in a tap water testing device. And then, an approach can be designed to target those households specifically, which may well be via a different channel than social media, for example by doing a survey at the local pool, where water-loving parents take their children for a swim.

Easy enough for B2C, but what about B2B?

A lot of the statistical and demographic data used in the above-mentioned example is freely available on the internet. But what to do when the target market is not a private consumer but a municipal drinking water or wastewater utility? The good news is that a lot of general information about municipal utilities and water quality is also available on the internet, for example on the website of the World Health Organisation (WHO) or umbrella organisations such as the European Federation of National Associations of Water Services (EUREAU). But insights into water quality concerns of individual utilities are much harder to come by, and often require the involvement of (expensive) expert consultants with many years of experience in the industry. Market insights are available only if you are willing to spend thousands of Euros on a snapshot report. Serious digging may require financial resources that especially a startup does not (yet) have. So, then what?

For startup sensor developers looking to enter the municipal drinking water and wastewater utility market segment, Sensileau has developed a solution. Personally, I think it is important not to outsource the initial market research, because by doing the digging, the startup team learns incredibly valuable lessons about the industry they are targeting. But lack of experience and good quality data can certainly hamper an effective market analysis and may lead to the wrong conclusions. Therefore, we have designed an approach that includes the best of both worlds: the startup team does a considerable part of the leg work, while being pointed in the right direction and fed with useful information by our experts on sensor technologies and water quality monitoring. This takes the format of either a training course during which the participants carry out the market research in small steps as part of the homework for the course while being closely supervised by the trainers, or as a series of three or four workshops over the course of several weeks for more experienced teams. In this way, the costs are much lower than when outsourced, while the developers gain essential insights and the expert(s) involved ensure that essential market information is unearthed, sufficiently investigated and properly interpreted.

Beachhead market selection

A properly executed market analysis at a sufficiently detailed level is a good basis to draw up a shortlist of potential beachhead market segments. Next, a competitive landscape analysis can help to narrow down the options further and avoid market segments already dominated by strong competitors with similar offerings. In the second episode of this blog-series, I emphasised the importance of conducting a competitor analysis from the perspective of specific target customer groups. Their previous attempts to find a solution to the problem your technology solves will determine who your main competitors are.

The sustainability dimension

Another essential step in the go-to-market strategy is to find out how to attract the potential customers as identified in the market research. For water and wastewater utilities, sustainability benefits can be an important driver for implementing sensor technologies, and this can be used in effective marketing strategies.

In Episode 2 of this blog-series, I referred to the Climate Impact Forecast (CIF) tool to establish whether a technology actually has a positive climate impact. Given the (climate) goals and objectives that many water utilities have committed themselves to, it is important for technology developers to show how their products contribute to utilities achieving those goals. One way of doing so is by implementing Environmental, Social and Governance principles (ESG). Although ESG has recently gained a questionable reputation in relation to greenwashing, the principles themselves can be very useful and not just for well-established companies. Startups would do well to implement ESG-principles from the very beginning as it helps them to focus on what is really important, and can save them a lot of time and effort during the upscaling phase, according to Bruce Simpson and Cait Brumme. For sensor startups in the water industry, the E in ESG could be related to how sensor technologies can help a water utility to minimise chemicals and energy consumption by optimising water treatment and transport processes. Internally, the E forms an incentive to focus on building sensors which can be re-used, refurbished or regenerated rather than used as single-measurement disposables. The S relates to sensors helping to minimise the costs for safe drinking water production and wastewater processing in order to keep/make clean water and sanitation affordable for everyone. This translates as a constant search for low-cost sensing technologies with similar or better performance than more expensive alternatives. And the G includes protocols to ensure a utility’s (cyber) security throughout its digital transition and increased (remote) water quality data collection, forcing the sensor startup to select or build a data platform conforming to stringent security requirements.

In summary

Providing early and affordable support to sensor startups to drill down on customer segments for their market analysis is essential to increase their chances of success. An early focus on ESG-principles can give startups a head start and helps to avoid having to catch up during the scale-up phase.